The 83(b) election process is well known in the start-up industry. Founders are advised by their tax and/or legal advisors to file an 83(b) election after their unvested shares are granted. If the company is expected to grow rapidly, its price per share is expected to increase as well. Under such circumstances, filing the 83(b) election to recognize the unvested shares when the price is still nominal may save you a meaningful amount on taxes.

Things you should know about 83(b) election:

- It only applies to restricted stocks and stock options, not RSUs.

- It only applies to shares subject to vesting. If your shares are fully vested, no 83(b) election is required.

- It shall be filed within 30 days of the approval of the grant by the board (please note the clock starts at the time of grant, not at the time of vesting).

- Make three copies of your filed forms. One for the IRS, one for the company, and one for yourself.

- If the value of the shares is likely to go up significantly, then filing an 83(b) election will benefit you on taxes; if the value of the shares is likely to go down, then filing an 83(b) election is not recommended.

- After you filed 83(b) election, you need to pay ordinary income tax based on the share value, but you do not need to pay tax each time the stock vests, instead, you pay tax when you sell the stocks.

- If an employee filed an 83(b) election but later their unvested shares are forfeited, section 83(b)(1) provides that no tax deduction shall be allowed with respect to such forfeiture.

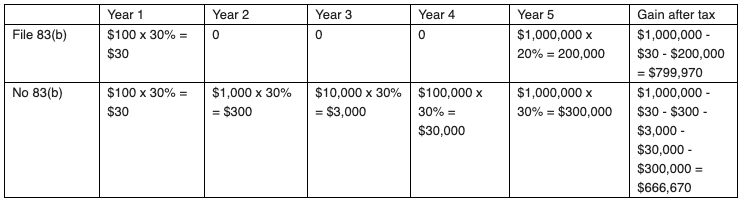

For example, assume the following:

- Year 1 (grant): Stock price $0.0001/share, number of shares: 1,000,000, total value: $100.

- Year 2: stock price $0.001/share, total value: $1,000.

- Year 3: stock price $0.01/share, total value: $10,000.

- Year 4: stock price $0.1/share, total value: $100,000.

- Year 5 (sale): stock price $1/share, total value: $1,000,000

- Income tax rate: 30%

- Long term capital gain rate: 20%

Then the tax result would be:

Therefore, filing 83(b) election would save $799,970 - $666,670 = $133,300.

Therefore, filing 83(b) election would save $799,970 - $666,670 = $133,300.

“Substantial Risk of Forfeiture”

As stated above, when the shares are fully vested, there is no risk of forfeiture, thus no 83(b) election is required. For the purpose of Section 83, shares are vested if they (1) no longer subject to "substantial risk of forfeiture", or (2) transferred to any person other than the person for whom such services are performed. Thus, whether you should file an 83(b) election depends on whether your stocks are subject to a substantial risk of forfeiture or whether your stocks are transferable. “Substantial risk of forfeiture” is usually more confusing than the transferability requirement. IRS code 83(c)(1) defines "substantial risk of forfeiture" as follows:

"The rights of a person in property are subject to a substantial risk of forfeiture if such person’s rights to full enjoyment of such property are conditioned upon the future performance of substantial services by any individual."

Therefore, the forfeiture is conditioned upon the future performance of the service provider (employee). This condition has to be (i) a service condition or (ii) a condition related to the purpose of the transfer.

In a final regulation published by IRS in 2014, it further clarifies the definition of Substantial Risk of Forfeiture, and specifically clarified that

"(1) except as specifically provided in section 83(c)(3) and §§ 1.83–3(j) and (k), a substantial risk of forfeiture may be established only through a service condition or a condition related to the purpose of the transfer, (2) in determining whether a substantial risk of forfeiture exists based on a condition related to the purpose of the transfer, both the likelihood that the forfeiture event will occur and the likelihood that the forfeiture will be enforced must be considered, and (3) except as specifically provided in section 83(c)(3) and §§ 1.83–3(j) and (k), transfer restrictions do not create a substantial risk of forfeiture, including transfer restrictions that carry the potential for forfeiture or disgorgement of some or all of the property, or other penalties, if the restriction is violated.”

The final regulation also addresses that

"an involuntary separation from service without cause cannot qualify as a substantial risk of forfeiture under section 83 if property is not transferred until after the separation from service occurs."

Per 26 C.F.R. § 1.83-3(c)(2), the following examples are listed regarding the substantial risk of forfeiture:

- Where stock is transferred to an underwriter prior to a public offering and the full enjoyment of such stock is expressly or impliedly conditioned upon the successful completion of the underwriting, the stock is subject to a substantial risk of forfeiture.

- Where an employee receives property from an employer subject to a requirement that it be returned if the total earnings of the employer do not increase, such property is subject to a substantial risk of forfeiture.

- Requirements that the property be returned to the employer if the employee is discharged for cause or for committing a crime will not be considered to result in a substantial risk of forfeiture.

- An enforceable requirement that the property be returned to the employer if the employee accepts a job with a competing firm will not ordinarily be considered to result in a substantial risk of forfeiture unless the particular facts and circumstances indicate the contrary.

83(b) elections can be very confusing for young engineers who receive restricted stocks or options from their employers. It is highly recommended to consult a tax and/or legal professional when filing the 83(b) election.